Brands that maintain PPC ads during Q5 can capture valuable ad inventory at lower costs, as CPCs drop and impressions surge, study finds.

Many brands cut back on paid search ads in the post-holiday period, leaving an opening for savvier marketers to scoop up valuable inventory at lower costs. That’s according to a report by Google Ads optimization platform GOA Marketing.

By the numbers:

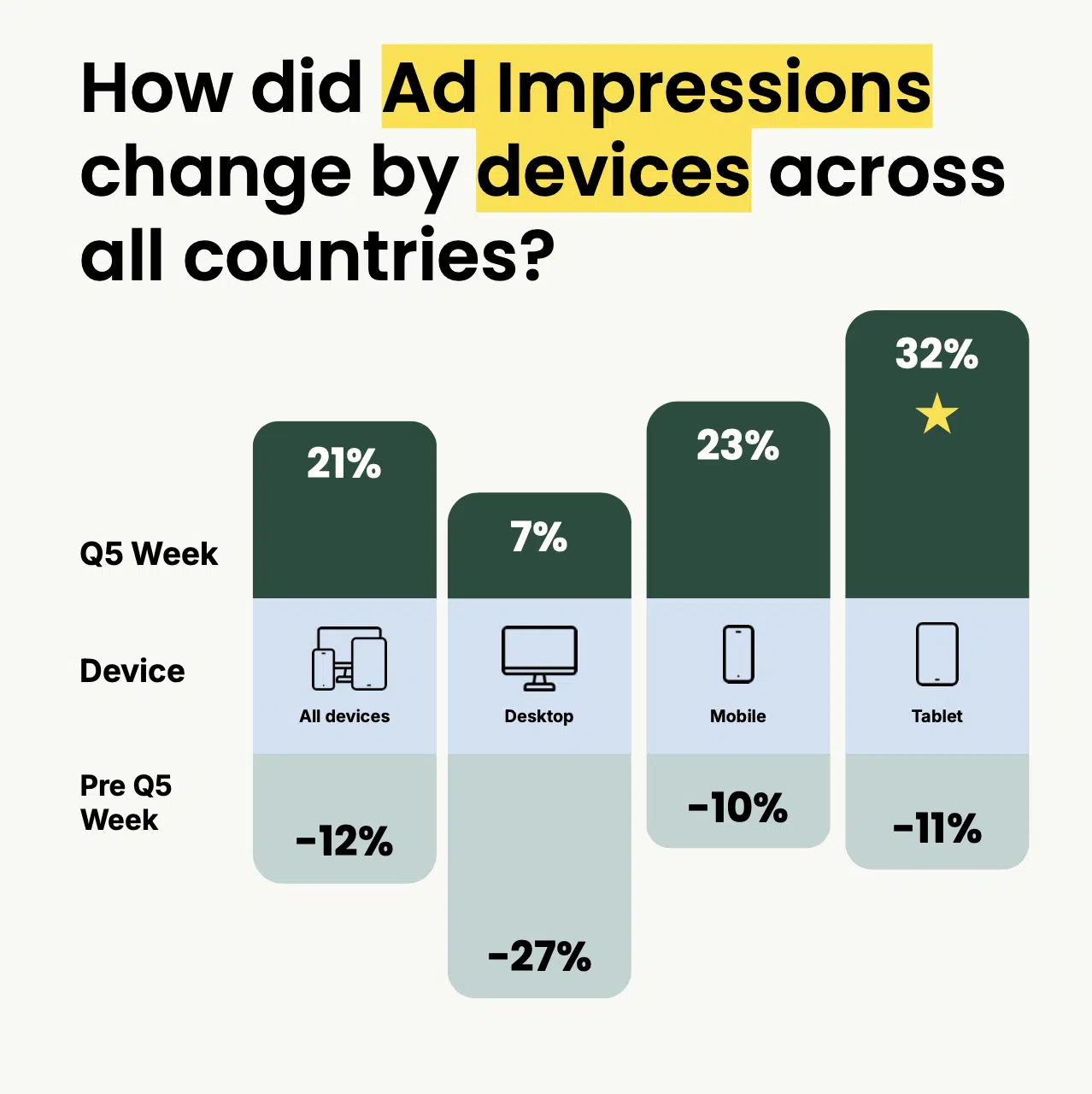

- Q5 (the period from Dec 25 to Jan. 1) saw a 21% increase in Google ad impressions compared to the prior three-week period.

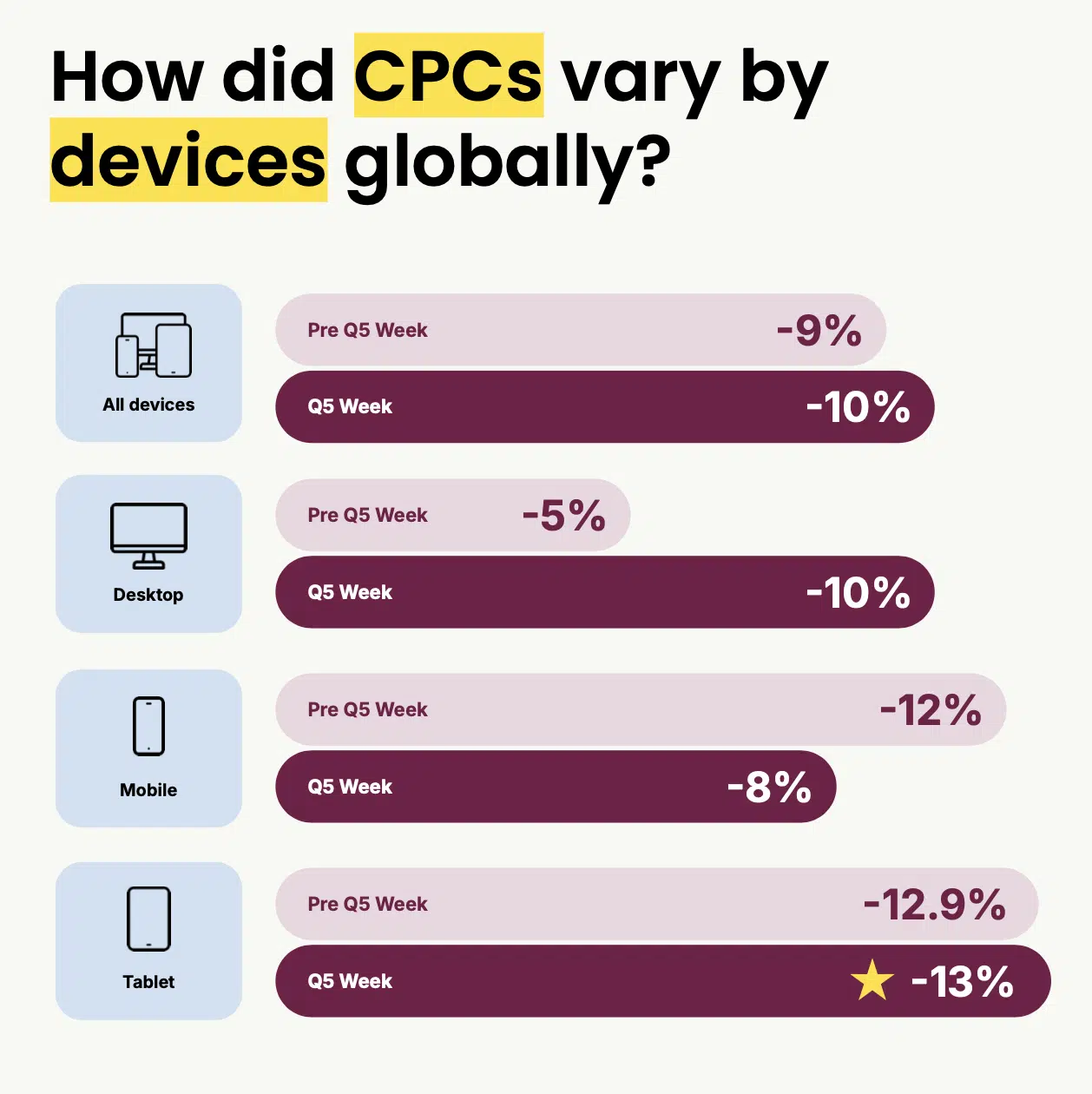

- CPCs dropped 10% across devices during Q5, creating opportunities for cost savings.

- Mobile and tablet impressions saw the biggest jumps, up 23% and 32% respectively.

- The U.S. had a 94% surge in impressions during Q5, while the U.K. saw a 10% increase.

Why we care. With many brands pulling back on ads after the holidays, Q5 provides a window for those willing to stay active to capture valuable consumer attention at lower costs. The data shows significant regional differences, so advertisers need to tailor their strategies accordingly.

The big takeaway. “With lower CPCs, a more aggressive bidding strategy could be effective in capturing additional ad inventory and maximizing reach,” the report states (registration required). But it also cautions brands not to overlook opportunities on tablets and to avoid a one-size-fits-all global approach.

Bottom line. For brands willing to keep the pedal down after the holiday rush, Q5 appears to offer an underutilized opportunity to drive performance and get a head start on the new year.