Higher revenue per search couldn’t offset lower volume in the fourth quarter of its fiscal year 2019.

Microsoft reported better-than-expected quarterly earnings Thursday, with revenues increasing 12% year-over-year to $33.7 billion. Yet the two sectors of the company that matter most to digital advertisers — search advertising and LinkedIn — again saw declining year-over-year growth in the final quarter of its fiscal 2019, which ended June 30.

Single-digit revenue growth for search advertising. With an increase of just 9% in the fourth quarter compared to the prior year, search advertising revenue grew slower than expected last quarter, the company’s CFO Amy Hood said during Microsoft’s earnings call Thursday evening.

Search advertising revenue increased by $184 million year-over-year, though Microsoft did not disclose what its total search revenue was for the quarter.

Hood said search advertising experienced lower volume than the company had expected and that growth was driven by higher revenue per search.

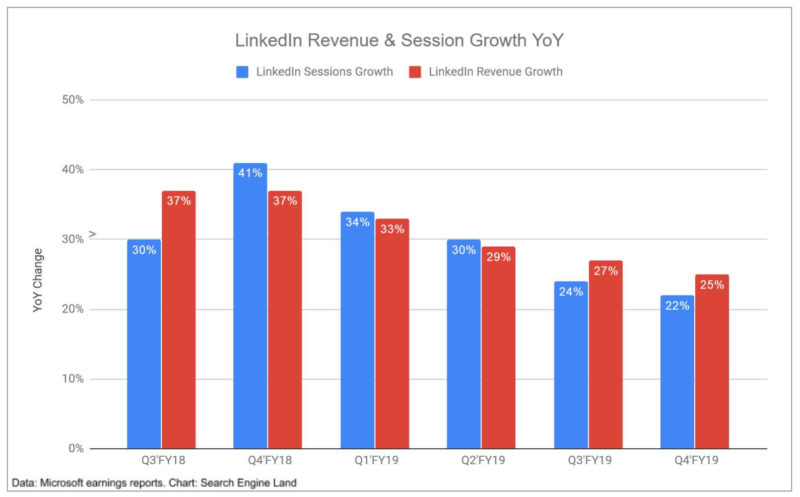

LinkedIn slowing continued. While still in the double-digits, LinkedIn revenue and session growth has been slowing for several quarters. LinkedIn sessions increased 22% year-over-year, while revenue grew by 25%.

Why we should care. Bing Ads rebranded as Microsoft Advertising at the end of April, highlighting the advertising group’s broader offerings beyond search inventory and data. Artificial intelligence and LinkedIn data for ad targeting have opened up opportunities for Microsoft Advertising to do more interesting things than simply follow in Google’s steps. Still, volume has been an issue, particularly on mobile, and is clearly one the company continues to struggle with.

Google will report its second-quarter earnings next week, but it, too, has reported slowing ad revenue growth for the past four quarters.

Microsoft’s search advertising business encompasses search ads on Bing and across the Microsoft Audience Network, which serves native ads on Outlook, MSN.com and Microsoft’s Edge browser.

Microsoft continued to note — as it has done in every quarter of its 2019 fiscal year — that LinkedIn continued to see “record levels of engagement.” LinkedIn has continued to invest in advertising capabilities and technology, including the addition of lookalike targeting, interest targeting that integrates Bing search data and more than 20 predefined business audiences for ad targeting at the end of March. At the end of May, LinkedIn announced it had entered a deal to acquire identity resolution platform Drawbridge to boost ad engagement and results for advertisers.