Though they’re ticking back up, decreased CPMs are still a buying opportunity.

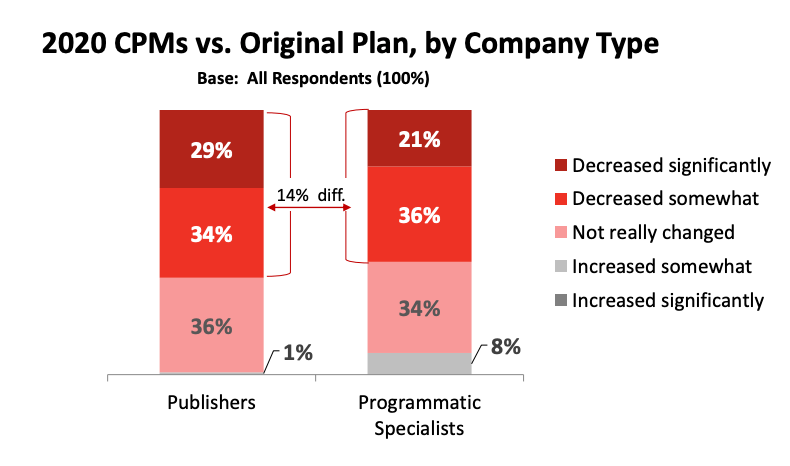

62% seeing declines. Using a sample of 173 publishers and “programmatic specialists” (SSPs, Ad Exchanges, Ad Networks), the trade body reports that 62% of publishers have seen significantly or somewhat reduced CPMs in the face of ad budget cuts and diminished advertiser competition.

The survey was conducted between April 29 and May 11.

Programmatic less impacted. Programmatic providers have been less impacted overall, with a few even seeing rate increases, compared with publishers that offer direct ad sales. Publishers have cut CPM rates in an effort to remain competitive and maintain revenue. Online news publishers may be among the hardest hit.

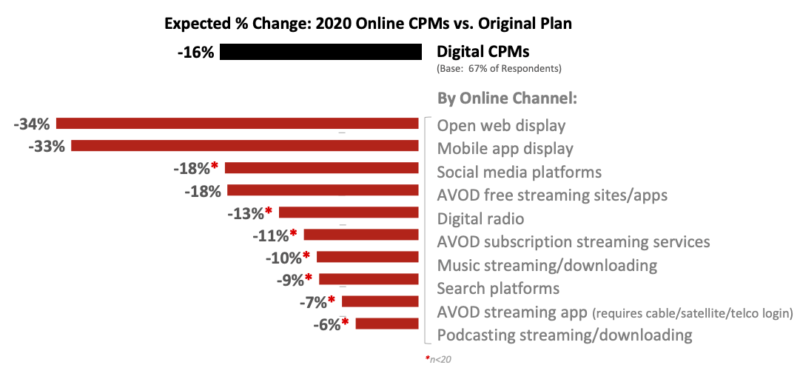

The biggest CPM price drops have happened in the category of “open web display” ads, followed by mobile web advertising, which are off 34% and 33%, respectively. By comparison, social media advertising is down by 18%. CPM prices on desktop overall are down 27%; they’re off 28% on mobile phones. The channel that has been most resistant to price declines (or resilient) is connected TV, according to the survey.

These publisher-respondents project an average CPM revenue decline of 16% for the full year, compared with original 2020 forecasts. While the sample is small, it’s undoubtedly directionally accurate and suggests that if there is ad revenue growth in 2020, it will be in the very low single digits.

Why we care. It makes sense that programmatic networks have seen fewer declines, as many advertisers essentially abandoned harder-to-measure brand or awareness advertising and focused more narrowly on performance and lower funnel strategies. These reduced CPMs — which are starting to increase — represent a buying opportunity for marketers and brands now seeking to reactivate or re-engage with customers and prospects.

As budgets start to return in early Q3, the discounts may not last that much longer.