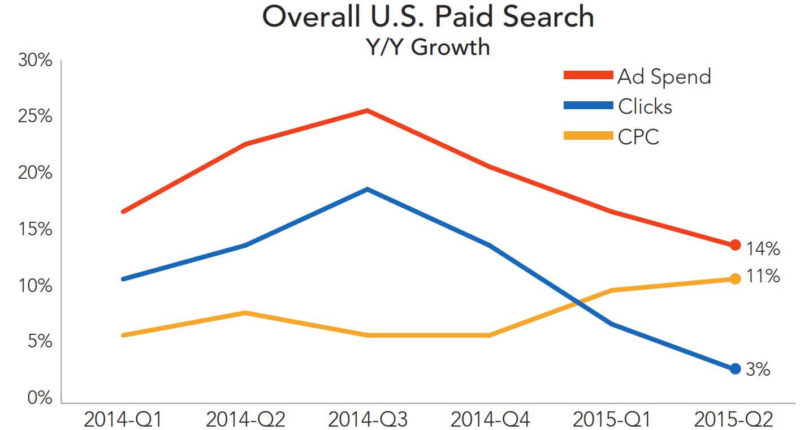

Paid search ad spend growth continued to decelerate and clicks rose just 3 percent in Q2, according to Merkle RKG.

Search ad spend growth slowed in the US, rising 14 percent year-over-year in Q2 for Merkle RKG’s predominantly large retail clients. The firm’s latest Digital Marketing Report says that higher CPCs hindered click growth for the quarter as advertisers aimed to maintain efficiencies in their search programs.

Clicks rose just 3 percent in Q2, down 14 percent from the prior year. CPCs climbed again, rising 11 percent year-over-year in Q2.

Tablet click growth slowed to an increase of just 1 percent, while phone click volume rose 35 percent year-over-year. Overall, tablets and phones generated 41 percent of search ad clicks and accounted for 31 percent of spend.

Phone revenue-per-click is slowly improving. In Q2, RPC for phones was 58 percent lower than on desktop, compared to 66 percent a year ago.

Google: Growth Slowing; Steep Rise In Brand CPCs

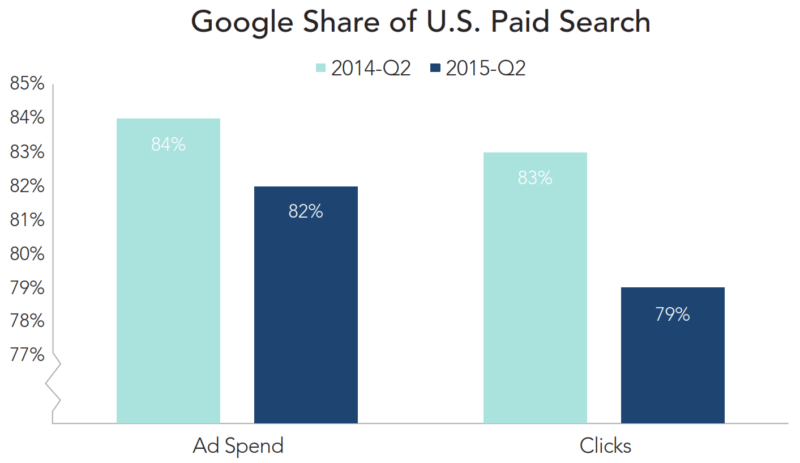

Google’s share of the paid search market among Merkle RKG clients fell from the previous year but remained steady from Q1. The year-over-year decline is in large part to Yahoo’s deal with Firefox to be the default search engine. The report found that Google lost roughly 2 percent of overall click share as a result of the deal.

Search ad spend on Google rose 12 percent, with CPCs rising 13 percent year-over-year in Q2. Clicks were off 1 percent compared to last year in the US. The report finds that higher CPCs were driven by a steep increase in brand keywords.

Brand: For the first time, brand clicks on Google were higher than on Bing, the report finds. This quarter, brand CPCs jumped nearly 40 percent compared to the previous year, with minimum CPCs three times higher than Q2 2014. In Q1, brand keyword CPCs rose just 10 percent year-over-year.

Non-brand: After four consecutive quarters of double-digit growth, Google CPCs on non-brand clicks rose just 4 percent year-over-year. Clicks rebounded after a 1 percent decline in Q1 to 4 percent year-over-year growth in Q1.

AOL Implications: For Merkle RKG clients, Google search partners generated 8 percent of Google’s overall search ad clicks, and partner AOL generated 1 percent of those clicks in Q2 2015. In a 10-year deal signed last month, Bing will begin serving search results and ads on AOL in the beginning of 2016 .

Bing: Non-brand Click Growth Driven By Product Ads

Overall: Search ad spend jumped 27 percent, and CPCs overall ticked up 2 percent year-over-year. Click volume growth slowed but still rose 24 percent, as Bing continued to benefit from Yahoo’s deal with Firefox. Roughly 10 points of that click volume growth was due to the Firefox deal. On the other end, ad traffic migration to Yahoo Gemini accounted for a 5-point loss in click growth (See below for more on Gemini).

Non-brand: Click volume growth slowed from 49 percent in Q1 to 35 percent in Q2 compared to last year, but growth is still strong, bolstered by Bing product ads. Non-brand CPCs were off 4 percent in Q2

Product Ads

Product ads (Google product listing ads and Bing product ads) continued to account for a larger share of retailer ad clicks overall. While text ad clicks across Bing and Google fell 5 percent, product ad clicks rose 41 percent. Ad spend on product ads jumped 35 percent compared to just 6 percent for text ads. CPCs, however, were off 5 percent among product ads, while text ad CPCs rose 11 percent.

Conversion rates on Google were 31 percent higher than Bing product ads in Q2, but that’s off from a 41 percent advantage a year ago.

Google: Clicks on Google product listing ads rose 30 percent year-over-year, generating 32 percent of retailers’ search ad clicks and 57 percent of non-brand ad clicks on Google.

Overall, average order value from product listing ads remained lower than order value from text ads (off 13 percent in Q2). Merkle RKG suggests that Purchases on Google (what had been referred to as the Google Buy Button), which was just announced this week, may widen that gap “depending on the cross-selling and upselling capabilities afforded to advertisers.”

ROI on Google PLAs remained 12 percent higher than text ads in Q2 (down just slightly from 13 percent last year).

Bing: Bing product ads continue to ramp. Product ad clicks accounted for 12 percent of retailers’ ad clicks on Bing, compared to just 3 percent a year ago. Click volume rose 400 percent year-over-year and generated 22 percent of retailers’ Bing Ads clicks, up from 6 percent in Q2 2014.

Product ad CPCs continue to be lower than last year, off 5 percent this quarter from 2014.

Yahoo Gemini

Yahoo’s relatively new platform, Gemini, accounted for 15 percent of total Yahoo Bing Network search ad clicks across all devices. Originally designed to serve mobile search ads, now Gemini can also serve ads to desktop search traffic as a result of the renegotiated search deal with Microsoft in April.

Yahoo can also serve 49 percent of ads on desktop search from other partners under the new agreement and has confirmed serving Google search results, including ads, in a test on its properties.

Yahoo can also serve 49 percent of ads on desktop search from other partners under the new agreement and has confirmed serving Google search results, including ads, in a test on its properties.