Here are some results of Prime Day’s impact in the Google search channel, what they mean for the coming weeks and other major trends on the back-to-school season and beyond.

But the bigger trend is that Prime Day is no longer confined to Amazon. It pervades the entire retail industry, with shopping interest heightening across multiple marketing channels.

Including Google search.

My colleagues and I took a look at some of the biggest trends influencing back-to-school search marketing, from Prime Day and its halo effect, to newer Google Ad formats and targeting capabilities. Here are some results of Prime Day’s impact in the Google search channel, what they mean for the coming weeks and other major trends to capitalize on this back-to-school season and beyond.

1. Prime Day led to high search interest on Google

It’s no surprise Prime Day hype reached a new high this year, and Google Trends demonstrates it. Google Trend scores are relative to one another, meaning a 100 – which occurred during this year’s Prime Day week – represents the peak popularity of a search term over a period of time. Relatively speaking, searches for “Prime Day deals” on Google were 26 percent less popular in 2018.

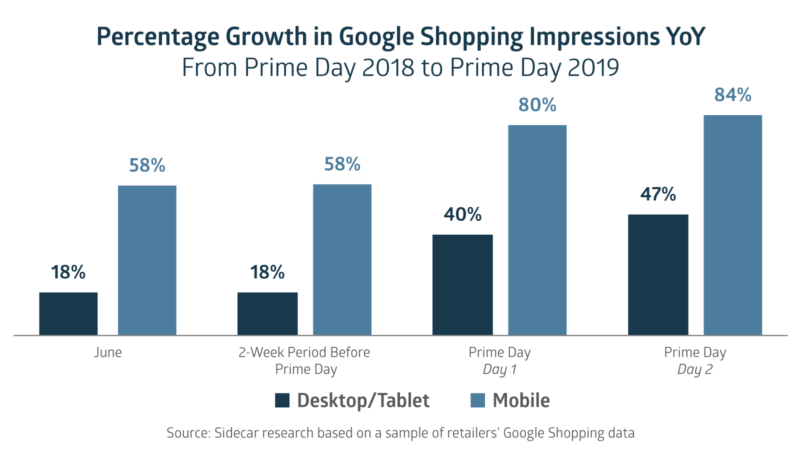

We also analyzed several hundred retailers’ Google Shopping impressions during June and July 2019 and compared them year over year to further understand the impact of Prime Day on Google search interest.

During the two weeks prior to Prime Day (which was July 1-14 in 2019, and July 2-15 in 2018), we found a 58-percent growth in Google Shopping mobile impressions. For context – that growth was exactly the same in June year over year.

The inflection point came on Prime Day, which ran 48 hours this year and 36 hours last year. Google Shopping mobile impressions grew by 80 percent on the first day of Prime Day 2019 (July 15) compared to the first day of Prime Day 2018 (July 16). The second day of Prime Day saw an 84 percent increase in mobile impressions year over year.

Desktop/tablet growth was even more pronounced, jumping from a modest 18 percent growth before Prime Day, to 40 percent and 47 percent respectively over the two-day sale.

2. The Prime Day halo effect creates opportunity in Google search

Why the increased search interest on Google, when Amazon was the behemoth running the sale? Consumers could have been price checking on Google Shopping (activity perhaps accelerated by Amazon’s recently revised price parity clause). Consumers also could have been seeing if products were available in a store nearby. Or, consumers were searching for discounted products offered by the many retailers that ran their own promotions during Prime Day.

This is further evidence that Prime Day transcends Amazon. The halo effect is creating heightened shopping interest across other channels, including Google search. As a result, retailers offering back-to-school products, as well as many other types of products, may see higher impressions in Google Ads over the next couple weeks as consumers continue to search for items that caught their eye during Prime Day, but didn’t purchase. The coming weeks also might deliver strong performance for retargeting campaigns you have running.

Additionally, July and August are shaping up to be a good time to potentially carry out dry runs for certain year-end holiday promotions, not just back-to-school promotions. Take advantage of the heightened brand awareness and shopping interest. Consider small tests to experiment with various discount amounts, coupon amounts, and promotional ad copy that you’ll run more broadly in Q4.

3. Back-to-school is a short and increasingly well-defined season

Prime Day has become the kickoff to the back-to-school season, offering deep discounts for price-conscious parents and students. From there, the seasonal peak continues to arrive early. For instance, for a multinational apparel and accessories brand, we found that July 30 to Aug. 5 was the top seven-day period in 2018 in terms of Google Shopping clicks and conversions for queries containing “backpack.”

The season tends to end as abruptly as it starts. For the same brand, the full week of Labor Day in 2018 (Sept. 2-8) saw a conversion rate dropoff of 50 percent on “backpack” terms from its seasonal peak performance.

As the back-to-school season progresses, remember there is less time for a click to convert within this season. That’s because Google Ads attributes orders to the click date, not the transaction date.

As always, it’s important to get in front of shoppers when they are figuring out what to buy and from where. Once shoppers have picked a retailer, they are likely to skip the search engine altogether, cutting other advertisers out of the equation entirely.

4. Back-to-school remains a frenzied competition

With only a short season to work with and competition fiercer than ever, proactively adjusting your bids is paramount to the success of your seasonal marketing strategy.

You’ve probably already referred to your performance data from last season as a guiding point for campaign and bidding strategies this year. If you haven’t, segment the performance of your top back-to-school products and keywords by day or week from the previous year to predict when performance trends up and down.

A best practice is to use revenue per click as your target KPI, because it considers both the increase in conversion rate and the downshift in average order values that come with heavy promotional periods.

Of course, as investment prospectuses always say, past performance is no guarantee of future performance. Rather, more recent performance (generally 30 days) of your top queries and products should be the base off which you build your predictive bid adjustments. Factors like inventory, product mix, competitive landscape, and changes to Google’s algorithm can have massive implications on performance year to year. Keep an eye on the future, but stay firmly planted in the now.

5. Electronics and clothing will be top sellers – but know which parts of YOUR catalog will be most in demand

A well-groomed Google Ads account is the key to dominating seasonality. Within Shopping, make sure you are setting up your campaigns, ad groups, or product groups to isolate your top back-to-school items. The top two expenses for back-to-school shoppers this year will be clothing and accessories, and electronics, according to the National Retail Federation. That said, review your past performance to pinpoint which items in your catalog will be most in demand.

If your product feed doesn’t have the most accurate or descriptive product types, consider using a custom label to tag your seasonal products. The more granular your bidding structure, the more control you have over which products you promote.

Within text ads, your campaigns are hopefully already grouped into themes. Rather than apply blanket adjustments to all your campaigns, bid up more selectively on keyword groups that represent your bestselling back-to-school products. Don’t forget to update your ad copy and landing pages for the season, especially if you are running promos or have created new seasonal site pages.

To get more advanced, consider creating a separate campaign for back-to-school keywords, so you can quickly and easily modify your spending on those terms after the Labor Day weekend dropoff.

6. Back-to-school search terms are likely to trigger Showcase Shopping ads

As I’ve shared in the past, Google continues to chip away at traditional shopping ads that display for broad queries on mobile. The replacement is the more visually engaging Showcase Shopping ad. This trend accelerated prior to the holiday season last year, meaning this is the first back-to-school shopping season where Showcase ads will be a major traffic driver.

Here’s a look at Showcase Shopping ad impressions for a sample of several hundred retailers over the past 18 months:

Search terms like “school supplies,” “backpacks,” and “kids apparel” are likely to trigger Showcase Shopping ads now. If you’re not in the Showcase game, you’re essentially missing out on all the impressions Google’s algorithm is now deciding should trigger a Showcase ad carousel. Check out these Showcase Shopping how-to’s I’ve shared on Search Engine Land for help on navigating the format.

7. Back-to-school is a key use case for Detailed Demographics

Back-to-school is also a good time to use Google’s Detailed Demographics with your shopping campaigns. Of particular interest during this season is the segment for parents—broken down by parents of infants (0-1), toddlers (1-3), preschoolers (4-5), grade-schoolers (6-12), and teens (13-17).

If your catalog spans all these age groups as well as adults without kids, it might make sense to segment your campaigns or ad groups by demographic targets, to hone in on the products most relevant to each audience.

Back to school, back to holiday planning

Once back-to-school reaches its end in September, the year-end holidays will enter the consumer conscience. Drive the best performance from your back-to-school campaigns now, while starting to shift your time into holiday planning mode. More to come in my column as the holiday season nears.