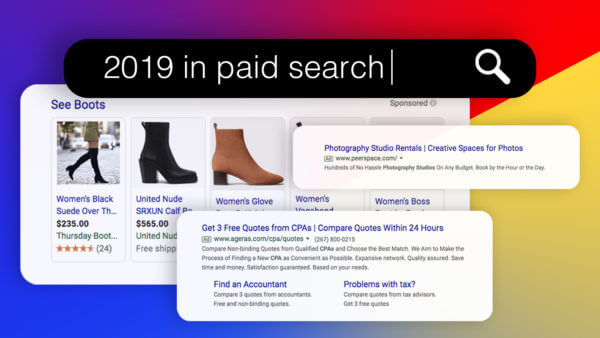

Automation, full-funnel campaigns, shoppable ads and privacy fueled PPC changes in 2019.

In 2019, Google shook up mobile search results pages with a redesign that introduced black “Ad” labels to text ads and favicons for organic listings. It also caused a stir in notifying some advertisers it would start handling campaign management for them. Automation continued to be a major theme. This year, it was reflected most prominently in Google’s product announcements aimed at owning the funnel with campaigns that extend across properties. Adjusting to new privacy restrictions and expectations also took on new urgency and will have a significant impact on search marketing in the year to come.

Bing celebrated its first decade. Ten years on, still, Bing’s market share doesn’t rival that of Google and likely never will – but perhaps that’s beside the point now. The newly-branded Microsoft Advertising doesn’t have to carry 90+% of its parent company’s revenues like rivals Facebook and Google’s ad businesses, and it began exhibiting more of an independent streak in 2019 rather than simply aiming to keep up with new Google Ads features (though, it’s still doing that, too).

These were the big things we said goodbye and hello to in paid search this year that will inform our campaigns in 2020.

We said goodbye to:

Average position metric. This old-timer rode off into the late fall sunset. The retirement of average position was more of a process headache than a loss in actionable data. Advertisers had months to shift their bidding strategies, reports and scripts to rely on the new position metrics that Google introduced in late 2018. Frederick Vallaeys of Optmyzr offered a history of the blurring of average position as an informative metric. The new impression share-based position metrics instead better indicate how often your ads appear above the organic listings.

Microsoft also introduced the new position metrics but said it is holding on to average position reporting. For now, anyway.

Accelerated delivery. Search and Shopping campaigns no longer have the option to have their ads serve as early and often as possible until the day ends or their daily budgets deplete. Accelerated delivery was a fan favorite for Shopping and brand campaigns with uncapped budgets, but Google said many still used it with capped daily budgets and that “this method can increase CPCs due to increased competition early in the day, or unintentionally spend most of your budget in earlier time zones.” Now, campaigns are optimized through standard delivery with Google’s algorithms based on the campaign’s goal, bidding strategy as well as contextual signals.

Close variants expansion (again). This (along with declining Google Ads support) topped the list of 2019 PPC changes that had the most impact on ad campaigns for many advertisers. On July 31, Google announced same-meaning close variants were expanding to phrase match and broad match modifier keywords.

Advertisers say they are still reeling from the change. With this update, Google announced changes to its keyword selection preferences to help prevent keywords from competing against each other. But Brad Geddes of Adalysis outlined examples of Google ignoring these new preferences and workflow changes needed for managing keyword hierarchies at SMX East this fall.

Position-based bidding strategies. Target search page location and target outranking share bid strategies in campaign and portfolio strategies were retired in June. This change fits with the shift away from average position to the new top impression share metrics cited above. Instead, position-focused campaigns were transitioned to Target impression share, introduced in 2018.

We said hello to:

Monetized Discover feed. Discovery campaigns (in closed beta) were among the big announcements at Google Marketing Live 2019. The new campaign type monetizes the Google Discover feed for the first time with native in-stream ads that fit the mold of Facebook single image and carousel ads — meaning advertisers can fairly easily repurpose existing creative. Like Google’s other automated campaign types, Discovery campaigns run across multiple Google properties, in this case, Discover feed, Gmail and the YouTube home feed.

Hotter digital commerce offerings. Amazon Advertising shows no signs of slowing and continues chipping at Google’s search ad dominance in the sector. Google is also no doubt feeling the pressure from social platforms: chiefly Instagram and to a lesser extent Snapchat and Pinterest. All that to say, there is a lot of innovation happening in digital commerce as the platforms jockey for ad budgets. A redesigned Google Shopping rolled out in the U.S. in October, ahead of the holiday season. Google Shopping Actions-powered “Buy on Google” features prominently in the new experience. Google also extended Shopping ads to more YouTube inventory and shoppable ads to Image search. Local campaigns gained access to Promoted Pins in Maps and catalog-style ads in Display in November. In August, Microsoft acquired PromoteIQ which enables advertisers to run product ads on retailer sites where their products are sold. There will be more to come on that in 2020.

More travel comparison ad widgets. A new sponsored comparison widget was spotted in Google search results for airport Car Rentals in November. It’s not clear how widespread this test is, but Google runs similar sponsored ad formats for Flights and Hotels in the search results.

More responsive search ads. Microsoft Advertising opened its RSA beta globally in September. As we wrote then, marketers should expect RSAs to eventually become the standard text ad format. RSAs are the direction that text ads and ad testing will continue heading — with the ad systems dynamically determining creatives at the time of auction and adjusting based on historical performance. And it’s not just happening in search, Facebook rolled out its version of responsive ads, dubbed Multiple Text Optimization, at the end of October.

Microsoft made ad customizers available globally in July. Advertisers can create ad customizer feeds in the Microsoft Advertising UI or simply import them from their Google Ads accounts.

New audiences. Previously available to YouTube and Display Network campaigns, affinity audiences came to Google Search in October. Affinity audience segments are created based on browsing behavior. Google also added seasonal event in-market audiences such as Black Friday and Christmas for Search and YouTube campaigns at that time.

Combined audiences in Search debuted in November. Google Search advertisers can build layered audiences using “and” logic to incorporate demographic, in-market, affinity or other audience targeting elements. This capability enables persona targeting and message testing in Search.

Microsoft enabled custom audiences for retargeting customers in most markets. Unlike Google and Facebook, for example, that allow advertisers to upload their customer lists of emails directly into the platform, Bing Ads has opted to partner with third-party data management platforms Adobe Audience Manager, LiveRamp and Oracle BlueKai.

Commuter targeting. Google quietly expanded location targeting for the reaching “People in your targeted locations” option to “People in or regularly in your targeted locations.” This means advertisers reach people who regularly commute or travel to their targeted locations even when those users aren’t physically there when they perform a search. Google doesn’t elaborate on the criteria for “regularly located in your target location” or provide any reporting on those users. The frequency and recency factors could make a difference to some businesses, Andrea Cruz, digital marketing manager at KoMarketing Associates, noted at the time.

New smart bidding levers. Smart bidding strategy max conversion value arrived in Google in August, with the aim of automatically optimizing for the greatest conversion value within your budget. Microsoft rolled out maximize clicks globally.

Google also launched seasonality adjustments for Search and Display (and eventually Shopping) campaigns, allowing advertisers to inform Google’s smart bidding algorithms about expected conversion rate bumps around promotions, product launches or more nuanced seasonal lifts and lulls specific to their businesses.

Campaign-level conversion settings and rules for Search and Display campaigns allow for more granular control with smart bidding. And for brick-and-mortar advertisers, store visits became available for smart bidding strategies to take foot traffic conversions into account.

New ad extensions. Action extensions debuted in Bing Ads, showcasing call-to-action buttons in text ads. Meanwhile, Google is testing lead gen extensions (again).

More attempts at display ads in search. Turns out, display ads in search is still hard. Gallery ads had a brief moment in 2019. Several months in, that beta quietly ended as Google regroups on it, perhaps taking a page from Discovery ads, which advertisers can typically re-purpose from existing Facebook ads.

For years, Google and Microsoft have experimented with display-like ads in search. And for years, those tests haven’t taken off. The exception is model automotive ads, which Google attempted to parlay to other industries with the Gallery ad format.

Microsoft also ran a short-lived experiment this year with a 3D ad format for Samsung. The desktop format expanded to allow users to rotate 360 degrees and zoom in on images of Samsung phone models.

Privacy adjustments and browser crackdowns on cookies. In 2019, Google’s Chrome, Mozilla’s Firefox and Apple’s Safari all introduced or expanded limitations on tracking cookies to varying degrees. Apple’s Webkit team rolled out the latest updates to Intelligent Tracking Prevention (ITP) for Safari in December. These efforts limit cookie pools for audience targeting, including retargeting campaigns, and limit analytics and attribution data collection from Safari, meaning advertisers lose visibility into how their campaigns are performing. For its part, Google is increasingly relying on machine learning models to inform how ads are delivered and measured when it doesn’t have access to data it could once count on. With the California Consumer Privacy Act (CCPA) taking effect at the start of 2020, the impact of privacy regulations and cookie limitations will continue to be a key issue for marketers in 2020.