Even if Apple’s smart speaker sales don’t grow, they could still generate $800 million this year.

On a recent trip to the Apple Store to get my iPhone battery replaced, I noticed that the HomePod was displayed off to the side, in an area of the store that didn’t command much attention. I took it as a sign either that Apple had given up on the device or that there was very low consumer demand.

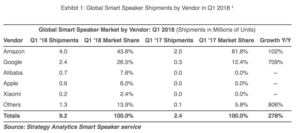

Now, a report from Strategy Analytics states that Apple shipped roughly 600,000 HomePods during Q1. By comparison, the same report put sales of Amazon Alexa devices at around 4 million for the same period. Google Home unit sales were about 2.5 million.

Undoubtedly, these numbers are imprecise; however, they indicate the relative size of each company’s market share. They also show that Google Home is gaining on Amazon’s virtual assistant.

Some financial analysts have predicted that, while the HomePod has underperformed, Apple will still exceed 2 million unit sales by the end of the year. That will come true if the device continues to sell 600,000 or more units each quarter for the remainder of the year.

By year-end, Apple would have sold roughly 2.4 million units. Because of the $349-per-unit price tag, that would still be an $800 million business for the company. There have also been rumors of a lower-priced model from Apple in time for the holidays — a HomePod mini or equivalent.

Earlier data from Slice Intelligence showed the following Q1 US smart speaker market share estimates:

- Alexa devices: 73 percent

- Google Home: 14 percent

- Apple HomePod: 10 percent

- Sonos One (running Alexa): 2 percent

The two biggest problems HomePod faces are related to price and perceptions of inferiority. While it is more expensive than most of its rivals, it’s not inferior. However, it does lack some features Alexa and Google Home possess (e.g., support for third-party music services), and it doesn’t have the same range as Google Home (e.g., general knowledge and calendaring functionality).